NFT investments are a new and exciting way to invest in digital assets, but they can be daunting for newcomers. Data analytics can help investors make sense of the complex and ever-changing world of NFTs and make informed decisions about where to invest their money. Continue reading to learn more about how data analytics is useful in NFT investments.

What is data analytics?

Data analytics is a process of inspecting, cleansing, transforming, and modeling data with the goal of discovering useful information, informing conclusions, and supporting decision-making. There are a variety of different techniques that can be used in data analytics, including statistical analysis, data mining, text analytics, predictive modeling, and data engineering.

Data engineering is the process of extracting meaning from data and turning it into something useful. This usually involves the use of complex algorithms and models, as well as specialized software and hardware. It is a critical process in data analytics and the foundation of data science, which in turn is the foundation of artificial intelligence. The ultimate goal of data engineering is to make the data ready for analysis.

Data analysis can be used to make predictions about the future. By analyzing past data, investors can develop models that can be used to predict future trends and make informed decisions about what investments might be most profitable in the long run.

What is an NFT?

NFT is an acronym for “non-fungible token.” It is a type of cryptocurrency that represents unique digital assets. These assets can be anything from game items to collectibles. Each NFT is different and cannot be replaced by another. This makes them ideal for representing digital assets that have value and cannot be replicated. NFTs are created on a blockchain platform, such as Ethereum, and can be stored and transferred using a wallet. They can also be traded on decentralized exchanges, allowing users to buy and sell them just like any other cryptocurrency.

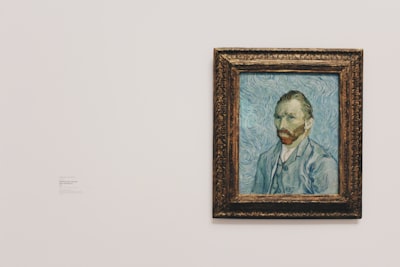

One of the advantages of NFTs is that they can be used to create digital scarcity. This is important for assets that hold value, as it ensures that they cannot be duplicated or overproduced. This helps to protect their value and create a more secure ecosystem. For example, digital artists and content creators can create things that have a limited supply, like digital art. NFT art collectors appreciate the uniqueness of each piece because unlike traditional art, which can be copied and reproduced, non-fungible art is one of a kind. This makes it a very valuable commodity, and it can often be worth a lot of money.

How can data analytics be used in NFT investments?

Data analytics can be used in a number of ways when it comes to NFT investments. The first way is to track the performance of the investment over time. This can be done by looking at the data to see how the investment has performed historically. This can help investors make informed decisions about whether or not to continue to invest in the NFT.

Another way data analytics can be used is to help identify patterns in the market. This can help investors make better decisions about when to buy and sell NFTs. Additionally, data analytics can help identify new opportunities in the market that may not have been previously identified.

When making any investment, due diligence is key. This process of gathering as much information as possible about a potential investment and its risks is critical in order to make informed decisions. Data analytics can support due diligence procedures for assessing new NFT investment opportunities.

Data analytics can also help to identify key factors that may influence the success or failure of an investment. By analyzing past data on investments in similar assets, analysts can develop predictive models that can help identify areas of risk and opportunity. This information can help investors make more informed choices about which investments to pursue and which to avoid.

Overall, data analytics can be a valuable tool for investors when it comes to NFT investments by building a more comprehensive picture of an investment. By integrating data from multiple sources, analysts and investors can identify potential risks and rewards that may be hidden in plain sight.